Featured

Table of Contents

If you utilize your desk on random events to catch up on development notes, the location does not qualify as a home office. If you sit at it to write progress notes everyday of the week, it will. With precedence, meaning it's your top place of business. You don't invest 90% of your functioning hours at a different office, then utilize your extra area for take-home work.

Depending on your circumstances, one technique may result in a bigger tax obligation write-off than the other. If you utilize Square, Stripe, or comparable services to gather settlements from customers, those charges are 100% tax obligation deductible. This applies to both level monthly fees you pay to make use of these solutions, and any type of percents of your profits they collect.

It may use annual records, telling you how much you paid in charges every year. The subscription prices of software you use for scheduling customer visits is 100% tax insurance deductible. Is the expense of any kind of software application you use to invoice clients or supply them with invoices. Many invoicing software application, such as Ivy Pay or Stripe, gather a percent of your income when clients pay by charge card.

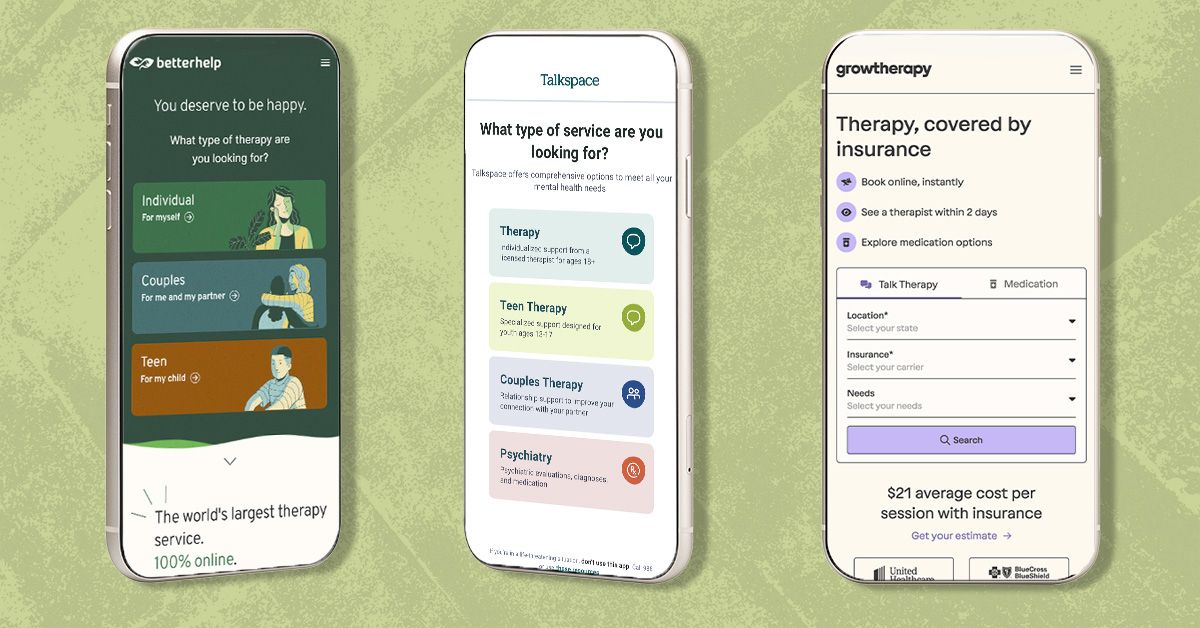

Main Topic Cluster: Online Counseling Services

This insurance coverage protects your technique from cases of negligence or carelessness in the making of specialist services. Since it is thought about a common and needed overhead for therapists, professional liability insurance policy is usually considered tax obligation deductible. This indicates that you are able to write off the expense of your insurance policy premiums on your tax obligation return.

Like expert liability insurance, the expense of basic obligation insurance premiums are tax deductible and can be asserted as a reduction on your income tax return. Make certain to record all settlements made towards your plan, as this info will be essential when submitting your tax obligations at the beginning of the year.

If you pay over $600 in passion during the program of the year, you can assert the expense on your tax return. Find out much more from our guide to the. The QBI deduction allows you cross out approximately 20% of your revenue, and many solo therapists get approved for it.

The Truth: Facing the Barriers

This guide is developed particularly for therapists that bill. Whether that's for all clients or simply a few, this guide is applicable.

This includes what individuals are stating on Reddit, LinkedIn, and in our own discussions with companies in the area. This is not a paid roundup, it's just our honest consider the very best out-of-network billing software application for psychological wellness. I work very closely with Thrizer, I've aimed to keep this comparison reasonable and clear.

And what establishes it apart comes down to three core points: Insurance claims are filed automatically as quickly as payment is charged. As soon as the system is established, there's nothing else you or your client has to do. Since clients are already paying out-of-pocket during this stage, Thrizer doesn't tack on added charges.

Once a customer fulfills their deductible, Thrizer allows them pay simply their copay. Now let's take a critical look at just how Thrizer stacks up utilizing our review criteria.

Supporting Cluster: Specialty Remote Services

As soon as repayment is processed, insurance claims are submitted with no action called for from the therapist or client. Arrangement is easy, there's no need to switch over EHRs, and prices is clear: therapists pay a 3% processing cost and customers just pay if compensation is effective.

The largest value-add is their mobile application, which allows either you or your customers to submit claims in just a few taps. They assert that Thrizer prices $860 per month for 20 customers at $200 per session.

It's additionally worth keeping in mind that some former Reimbursify users have actually moved over to Thrizer and reported a better general experience. One example is Audrey Schoen, a qualified therapist that switched over and shared her success story publicly. Currently let's take a better check out just how Reimbursify executes across the 8 core criteria.

What AI Can Handle

While it's cost-efficient for reduced volumes, scaling up means more hands-on steps and higher fees. Assistance reviews are blended, and there's no straight assimilation with EHRs regarding I can tell.: Handbook insurance claim submission via application or portal; superbill upload sustained: Very very easy to set up and use; no system alters called for: Application guides clients via entries; condition updates using mobile: $3.99/ claim or marked down packages; cost-free for customers on greater specialist strategies: No automation; all submissions are user-initiated: Completely HIPAA-compliant with safe, encrypted submissions: Email-based support; some records of sluggish or vague interaction: Mobile application is a standout; benefits mosaic available however no real-time pricing devices It's a solid, affordable option for specialists that currently generate superbills and intend to provide customers a faster way to send claims.

Latest Posts

The Gap Between Understanding and Transformation

Healing Retreats: Reaching Peace in RI

When Personal Work Enables Couple Healing